![]()

Written By Liz Eggleston

Course Report strives to create the most trust-worthy content about coding bootcamps. Read more about Course Report’s Editorial Policy and How We Make Money.

Overview

Tech has long been an industry offering excellent pay, balanced working hours, and opportunities with some of the world’s most prestigious companies. However, in recent years, we’ve seen an exciting paradigm shift, ushering in new opportunities and innovations that are reshaping the landscape for tech professionals.

According to the U.S. Bureau of Labor Statistics, computer and information technology jobs are projected to grow 4% from 2023 to 2033 with an increase of 6.7M, much faster than the average for all occupations.

The same data found that approximately 356,700 job openings are projected annually, with a median annual wage of $104,420 as of May 2023. This is more than double the median annual wage for all occupations, which stands at $48,060.

The data experts at Course Report set out to explore how the tech industry’s geographic landscape is evolving. With the rise of remote work and tech giants expanding into new regions, a “techxodus” is underway. Have the traditional tech strongholds in the U.S. maintained their dominance, or are new hubs emerging?

Key Findings

Course Report analyzed data from 222 million LinkedIn profiles of U.S. residents, focusing on 28 tech industries to map the concentration of America’s tech workforce across states and cities. The study also examined the distribution of seniority levels in these locations and pinpointed key hubs for specialized tech talent.

-

Tech workers make up 7.25% of America’s workforce, totaling 16.1 million people.

-

Washington (11.49%), New Hampshire (10.69%), and California (10.17%) have the highest proportion of tech workers relative to their total LinkedIn profiles.

-

San Francisco boasts the highest percentage of tech workers compared to its workforce at 22.54%, followed by San Jose (21.86%) and Seattle (16.48%).

-

Seattle has the highest percentage of senior tech talent while New York City leads in entry-level tech workers.

-

Seattle also ranks #1 for specialist tech workers, excelling in fields like artificial intelligence, product management and web development.

Results

The U.S. States with the Largest Proportion of Tech Workers

Some states naturally have a higher total number of tech workers due to their large populations. This included California with 2.42 million tech workers on LinkedIn, Texas with 1.33 million tech workers and New York with 991,000.

To provide a more accurate comparison, the study examined the percentage of tech workers relative to each state’s total LinkedIn profiles. This approach highlighted the states where tech professionals make up the largest proportion of the workforce.

Washington state leads the nation with 11.49% of its workforce employed in tech. This is hardly surprising as the state is home to some of the biggest tech giants in the U.S. including Microsoft, based in Redwood and Amazon with its headquarters in Seattle.

New Hampshire has the second highest percentage of tech workers at 10.69%. Although the state is relatively small, it is strategically placed near the tech hub of Boston. Coupled with a lower cost of living—ranked 43rd in the nation by MERIC—and no state income tax, it’s an attractive option for remote or hybrid workers.

California ranks third in the nation for its concentration of tech workers, with 10.17% of the workforce employed in the industry. The state is a known and established tech hub with a long list of tech giants including Apple, Alphabet, Meta, Uber, Tesla, Intel, NVIDIA, Adobe, Netflix and PayPal, just to name a few.

Wyoming, North Dakota, and South Dakota report the lowest representation of tech workers in the United States, with only 5-6% of their workforce employed in the tech industry. These states are primarily known for industries like agriculture, mining, and energy. However, there’s room for growth as technology starts to play a bigger role in these traditional fields.

The States with the Most Skilled Tech Talent

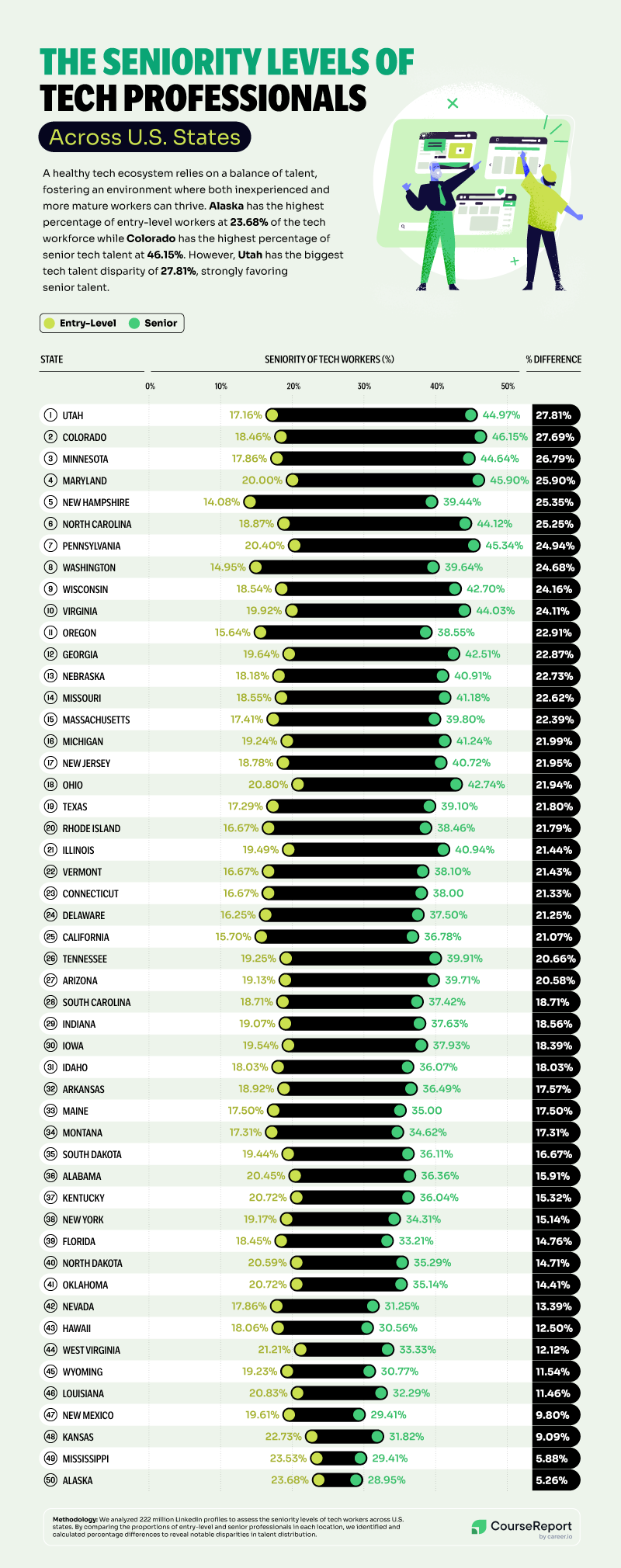

When examining the landscape of tech talent across the United States, it’s clear that some states stand out for their concentration of experienced professionals, while others are thriving on a growing pool of entry-level workers.

Colorado has the highest percentage of senior tech talent than any other state at 46.15%. This signals a well-established tech ecosystem with ample opportunities for experienced professionals. This is followed by Maryland with 45.90% of senior tech workers and Pennsylvania with 45.34%.

Alaska has the least experienced tech talent when compared to other states with 23.68% in entry-level roles. Mississippi follows close behind with 23.53% of less experienced tech workers and Kansas in third place with 22.73%. This suggests that these state’s tech industries are still in the early stages of development, with a growing demand for new talent and opportunities for junior workers to gain experience.

Utah, Colorado, and Minnesota stand out for having a significant gap between the percentage of senior and entry-level tech workers, with differences of up to 27%. This disparity, leaning in favour of senior talent, suggests that these states have well-established tech ecosystems with a high demand for experienced professionals.

Cities with the Highest Concentration of Tech Workers

While states often gain recognition as tech hubs, examining tech worker distribution at the city level provides deeper insight into localized ecosystems. Understanding the prevalence of tech workers in specific cities highlights where tech industries thrive, identifies emerging hotspots, and sheds light on how urban environments shape the growth of the tech sector.

When looking at the number of tech workers overall, the most populated cities are overrepresented with New York City coming out on top with 422,000 tech workers, followed by Los Angeles with 279,000 and San Francisco with 220,000.

San Francisco, California, has the biggest percentage of tech talent with 22.54% of its workforce in tech industries—nearly a quarter of the city’s total workforce. This prominence is driven by the presence of big-name companies including Apple, Google and Facebook alongside nurturing a hotbed of talent that’s sparked thousands of startups. The city also benefits from its proximity to major universities like Stanford and UC Berkeley, fuelling a pipeline of talent.

Close behind is San Jose, California, with the second-highest percentage of tech workers at 21.86%. This is no surprise, as San Jose is home to one of the most iconic tech hubs in the world: Silicon Valley. The city benefits from a unique concentration of top-tier universities, research institutions, and a thriving network of startups and established tech companies.

The third-biggest tech hub is Seattle with 16.48% of its workforce in the tech industry. The city’s success can be attributed to its strong presence of global tech giants, such as Microsoft and Amazon, both of which have major headquarters in the area. The city also boasts a highly educated workforce and a supportive ecosystem for innovation and tech development.

Austin, Raleigh and San Diego are rapidly emerging as significant tech hubs, with a growing percentage of their workforce employed in the tech industry. Austin, in particular, has become a hotspot for tech talent, with its combination of a strong job market, vibrant startup culture, and relatively lower cost of living compared to other major tech cities. More tech companies have started to establish a presence in Austin such as Apple, Google, Dell and Tesla.

This hints at the decentralization of traditional tech hubs like Silicon Valley and the Bay Area, with tech workers increasingly moving to locations that offer a lower cost of living, a higher quality of life, and growing job opportunities.

The Cities with the Most Skilled Tech Talent

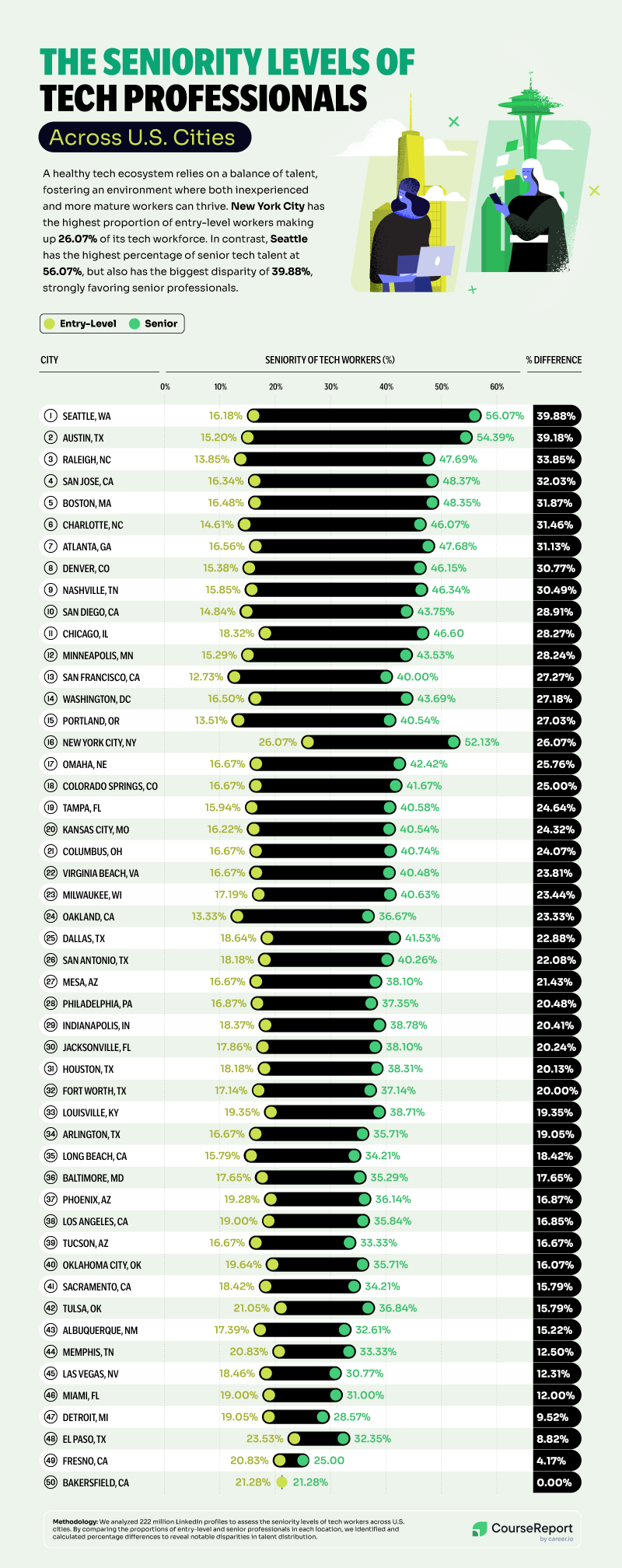

When it comes to tech talent, not all cities are created equal. Certain hubs have cultivated mature, senior-heavy workforces, while others excel at fostering entry-level opportunities.

This variation reveals the unique dynamics of tech ecosystems across the country, influenced by factors like the presence of major companies, economic conditions, and career growth opportunities.

Seattle has a mature tech community with senior talent making up a huge 56.07% of its workforce. This is followed by Austin and New York City. There are many contributors that could make a city foster more experienced talent such as the presence of established companies, strong job market, and opportunities for career progression. However, this also creates an ideal environment for newcomers, offering access to elite mentorship, a wealth of well-funded apprenticeships, and plenty of networking opportunities with industry veterans..

New York nurtures the most entry-level talent with 26.07% of its tech workforce at the junior level. This is followed by much smaller cities like El Paso, Texas, and Bakersfield, California. Interestingly San Francisco has the lowest percentage of entry-level tech talent, potentially indicating that the tech stronghold is not an appropriate location for younger tech workers to start their careers.

Seattle, Washington, Austin, Texas, and Raleigh, North Carolina are among the cities with the most unbalanced tech ecosystems, seeing significant gaps between entry-level and senior tech workers. This disparity may suggest a strong demand for experienced talent, limited opportunities for newcomers, or challenges in retaining junior workers. Such imbalances can create a competitive environment for hiring senior professionals while potentially stifling growth for early-career talent in these cities.

The Top Cities For Tech Specialists

While tech roles as a whole are in high demand, certain specializations have surged in popularity in recent years, driven by innovations like artificial intelligence and the rapid growth of the cyber security sector.

Specific cities have emerged as hubs for these specialisms, potentially due to nearby universities offering specialist tech courses, a boom in startups, or established companies in the area driving demand for specific skills and expertise.

Explore the top cities for eight key tech specialisms below:

Seattle Has the Most AI Specialists, Product Managers and Web Developers

The Washington city of Seattle has firmly established itself as a leading hub for tech specializations in the U.S., enjoying the highest percentage of workers in fields such as artificial intelligence (20.81%), product management (10.98%), and web development (11.56%)

The world’s interest in artificial intelligence has boomed in the past couple of years with the launch of ChatGPT making machine learning an everyday experience and prominence of AI-centred tech giants like OpenAI. Other cities that are championing AI talent are San Francisco whose AI specialists represent 18.64% of its tech workforce and Boston with 15.69% of machine learning specialists.

Product management has become a cornerstone of the tech industry, ensuring that innovative ideas are successfully translated into impactful products. Cities leading the charge in product management other than Seattle include the Californian city of San Francisco with product managers representing 10.91% of the tech workforce and San Jose with 10.46%.

Web development remains one of the most sought-after career paths in tech, both lucrative and in demand with careers spanning from front end developers to full stack developers. Second to Seattle, Portland, Oregon has 7.84% of its tech workforce working in web development and San Francisco with 7.27% of specialists.

Boston, Massachusetts Is the Data Science Hub of the U.S.

The job market outlook for data scientists is very positive and has been growing throughout the past couple of years, with a projected 35% job growth from 2022 to 2032, significantly higher than the average for all occupations.

Boston, Massachusetts leads as the top city for data scientists with 5.38% of tech workers in this specialism, far ahead of the national average of just 1.29%. This is followed by Seattle, Washington with 4.68% of tech workers who work in data science and Arlington, Texas with 4.5%.

Colorado Springs, Colorado Is the Cyber Security Hub of the U.S.

Cyber security is one of the hottest job markets right now, with The United States Bureau of Labor Statistics forecasting a 32% increase in cybersecurity jobs from 2022 to 2032, much higher than the 3% average growth rate for all U.S. jobs.

Colorado Springs leads in cybersecurity with 7.5% of tech workers specializing in the field, followed by Virginia Beach, Virginia (7.14%) and San Antonio, Texas (6.88%). Their strong military ties are likely a leading factor, with Colorado Springs home to the U.S. Air Force Academy, NORAD, and Peterson Space Force Base, and Virginia Beach near Naval Station Norfolk, the world's largest naval base.

New York City, New York Is the Digital Marketing Hub of the U.S.

Digital marketers, who help companies grow through digital channels such as social media and email marketing are essential to the tech industry, helping businesses get in front of the right customers. New York City leads as the top city for digital marketing in tech with 6.87% of its tech workforce specializing in this field.

California emerges as the leading state for digital marketing professionals in tech, maintaining a strong presence across its major cities. Los Angeles ranks second overall, with 5.73% of its tech workforce specializing in digital marketing, followed closely by San Francisco at 5.45%.

San Jose, California Is the Cloud Computing Hub of the U.S.

Although cloud computing isn’t a new industry, its prominence and impact have grown significantly in the past two decades. Today, cloud computing is a foundational technology for many sectors, driving innovation in industries like healthcare, finance, and entertainment.

San Jose, California, stands out as the leading hub for cloud computing talent, with 12.42% of its tech workforce specializing in this field. Other cities also showcase a strong representation of cloud computing expertise, including Austin, Texas, where 11.7% of tech professionals focus on this area, and Seattle, Washington, with 10.4%.

Austin, Texas Is the Tech Sales Hub of the U.S.

The Texan city of Austin has firmly established itself as a prominent tech hub in recent years. One area where it particularly excels is tech sales, with an impressive 23.98% of its tech workforce specializing in this field—nearly double the national average of 12.48%.

Other cities making their mark in tech sales include Denver, Colorado, where 22.12% of tech workers are in sales roles, and Nashville, Tennessee, with 20.73% of its tech workforce specializing in sales.

Students Flock to AI and Cybersecurity Programs

When analyzing internal search data from Course Report’s own website, the career paths that prospective students were most interested in included full stack web development, cyber security and data science.

When comparing these tracks with the year prior, from 2023 to 2024, machine learning and AI have seen the largest increase in interest by 7.17%, while cyber security has increased in popularity by 3.47% and mobile app development by 2.07%

The full stack web development career path has seen a noticeable decline of 9.28% over the last year, along with UX design with a 2.7% decline and front end developer with a 2.65% drop. This could reflect market saturation or the perception that these are more established, less innovative paths compared to AI and cybersecurity.

|

Career Path |

% of Prospective Students (2023) |

% of Prospective Students (2024) |

% Difference |

|---|---|---|---|

|

Full Stack Web Development |

43.40% |

34.12% |

-9.28% |

|

Cyber Security |

23.70% |

27.17% |

3.47% |

|

Data Science |

12.67% |

11.86% |

-0.81% |

|

Machine Learning & AI |

1.24% |

8.41% |

7.17% |

|

Digital Marketing |

3.50% |

4.10% |

0.60% |

|

UX Design |

6.69% |

3.99% |

-2.70% |

|

Tech Sales |

1.23% |

2.91% |

1.68% |

|

Front End Development |

5.56% |

2.91% |

-2.65% |

|

Mobile App Development |

0.24% |

2.32% |

2.07% |

|

Product Management |

1.76% |

2.21% |

0.45% |

The study also looked at the location data from prospective students to see which bootcamps were most popular. California remains the top choice for coding bootcamps, with Texas and New York following closely behind.

When comparing data from 2023 to 2024, the rankings of these locations have remained consistent, with only minor fluctuations in interest. The most notable change is Texas, which experienced a 1.2% increase in interest over the past year, highlighting its growing appeal as a destination for aspiring coders.

|

Region |

% of Prospective Students (2023) |

% of Prospective Students (2024) |

% Difference |

|---|---|---|---|

|

California |

14.02% |

14.92% |

0.90% |

|

Texas |

10.30% |

11.50% |

1.20% |

|

New York |

10.13% |

9.94% |

-0.20% |

|

Florida |

7.44% |

6.55% |

-0.89% |

|

Georgia |

4.58% |

4.73% |

0.15% |

|

Illinois |

4.42% |

3.93% |

-0.49% |

|

Washington |

3.34% |

3.56% |

0.21% |

|

North Carolina |

3.23% |

3.52% |

0.29% |

|

Virginia |

3.29% |

3.07% |

-0.22 |

Liz Eggleston, CEO and co-founder of Course Report shares her insights:

“It’s no surprise that AI and cybersecurity are attracting so much interest right now as these fields are at the heart of where the tech industry is headed. Students are looking for careers that feel future-proof, which might explain why more traditional roles like full stack development are seeing a temporary dip – just remember that software and data skills are the fundamentals that power those hot new AI job titles.

At the same time, the shift in student interest toward states like Texas reflects a larger trend of decentralization in the tech industry. In 2025, a software engineer may be just as likely to land at a major bank in Chicago as they are to be working in Silicon Valley. As companies expand beyond traditional tech hubs, talent is following suit, attracted by lower costs of living, favorable business climates, and emerging tech ecosystems in places like Austin and Dallas.

The tech landscape is changing fast, and this data really highlights how important it is for education programs to keep up with those shifts to help students stay ahead.”

Launch Your Tech Career with Course Report

Coding remains one of the most lucrative, in-demand, and versatile skills for breaking into the tech industry, offering opportunities across a range of fields like software development, data science, cybersecurity, and artificial intelligence.

Use our Bootcamp Directory to find out which coding school is right for you, whether you’re seeking a full-time immersive experience, part-time learning, or specialized tracks to hone your expertise.

Participating Schools

n/a

Methodology

To determine the next emerging tech hub in the U.S., we analyzed 222 million LinkedIn profiles, utilizing the platform’s search function to pinpoint where tech workers are located across the country. The analysis was further broken down by factors such as seniority and specific tech specialisms.

We examined data for all 50 states, as well as the 50 most populous cities in 2024, drawing from the following sources: World Population Review’s U.S. Cities data and Wikipedia’s list of U.S. states.

Number of Tech Workers:

To find out the states and cities with the most tech workers, we isolated 28 tech industries on the LinkedIn platform and found out the total number of people working in these industries to denote 'tech workers'. We did this for every location. Then, we calculated the number of tech workers as a percentage of total LinkedIn profiles.

Tech Specialisms:

To find the tech hub for eight different specialisms, we analyzed keywords on LinkedIn for people working in our 28 tech-related industries and noted down the number of people in each specialism. We then calculated this as a percentage of those working in tech. We did this for the United States overall and for the top 50 most populated cities.

Seniority of Tech Workers:

To find the number of senior and entry-level tech workers for each location, we used LinkedIn's Sales Navigator search function to find the number of people who have a seniority of 'senior' or 'entry-level', We then calculated this as a percentage of total tech workers in each city and state, and then calculated the percentage difference between the seniorities.

Internal Course Report Data:

Finally, using internal data from CourseReport.com, we looked at the most popular tech specialisms for those taking part in a coding bootcamp, as well as the location in which these students lived. We compared data from 2023 to 2024.

The data was analyzed in December 2024.

About Course Report

Founded in 2013, Course Report is a research platform for immersive technology education. Use Course Report to get matched with highly-rated bootcamps, research 60,000+ coding bootcamp reviews, and choose the school that’s right for you, all in one place.